The world of estate planning and tax law can be complex, particularly when it comes to understanding the intricacies of inheritances and the implications for estate taxes. A recent client, Sarah, came to me with a perplexing situation. She had inherited a business from her late father, a successful entrepreneur. While she was thrilled to carry on his legacy, she was also anxious about the tax implications of inheriting the business at its current market value. Little did she know, a little something called a Section 754 Election could potentially save her considerable taxes. As I delved into Sarah’s case, I realized that understanding the Section 754 Election was crucial for her, and I knew it would be beneficial for many others in similar situations. This is why I’m dedicating this journal entry to breaking down this complex topic and offering insights to help you navigate a potential Section 754 Election.

Image: learningmagicbrewer.z5.web.core.windows.net

Understanding Section 754 Election: A Step-Up in Basis

The Section 754 Election is a powerful tool in estate planning, offering a potential tax advantage to beneficiaries who inherit a business, real estate, or other assets that have appreciated significantly in value. This section of the Internal Revenue Code allows an estate or trust to elect a “step-up” in the basis of inherited assets, meaning the beneficiary’s cost basis in the assets is adjusted to the fair market value on the date of death – effectively eliminating any potential capital gains tax on any appreciation that occurred before the inheritance.

This “step-up” in basis can be a game-changer, particularly when dealing with assets that have gained substantial value over time. Imagine, for example, inheriting a family business that your parents started decades ago. The business may have a relatively low book value but is currently worth millions thanks to years of growth and success. With a Section 754 Election, you’d inherit the business at its fair market value, meaning you wouldn’t owe capital gains tax on the appreciation that occurred during your parents’ ownership. To understand the Section 754 Election fully, we must delve into the intricacies of its function and implications.

The Basics of Section 754 Election: How It Works

The Section 754 Election operates within the context of partnerships and S corporations, where the ownership structure is based on shares or interests rather than individual assets. In these entities, each partner or shareholder possesses a “basis” – representing their ownership stake in the business. When a partner or shareholder dies, their interest passes to their beneficiaries. Under the general rules, the beneficiary’s basis is typically determined by the deceased partner’s basis, potentially resulting in a taxable gain if the asset is later sold at a price exceeding the beneficiary’s basis.

However, by making a Section 754 Election, the estate or trust can adjust the beneficiary’s basis to the fair market value of the partnership interest or S corporation stock on the date of death. This adjustment, known as “step-up in basis,” effectively eliminates any potential capital gains tax liability that would have arisen due to the appreciation prior to the inheritance. This means the beneficiary can sell the inherited asset at the fair market value without having to pay capital gains tax on the difference between the sale price and their inherited basis.

The Section 754 Election allows the estate or trust to step up the basis of the inherited interest to fair market value. This effectively “forgives” any capital gains tax liability on the appreciation of the asset before inheritance. The beneficiary now has a cost basis in the interest equal to its fair market value on the date of death, eliminating potential capital gains tax upon future sale.

Implications of a Section 754 Election: A Deeper Dive

While the Section 754 Election presents a significant tax benefit, understanding its implications is vital. Not all estates or trusts choose to elect this option, as it can potentially lead to increased taxable income in the future, depending on the particular circumstances. The key takeaway is understanding the implications of this election, ensuring that it aligns with your overall estate planning strategies.

Firstly, the Section 754 Election can trigger a tax liability if the inherited business subsequently distributes money or property to the beneficiary. This distribution could generate taxable income for the beneficiary, especially if the fair market value of the distributed asset exceeds the beneficiary’s basis. Secondly, remember that Section 754 is designed to affect the basis of the partnership interest or stock as a whole, not individual assets within the business. Upon the inheritance, the basis of a specific asset, like real estate or equipment, may need to be adjusted to reflect its fair market value. This internal adjustment is called a “Section 754 adjustment” and can be complex to handle.

Image: www.chegg.com

Navigating the Section 754 Election: Expert Tips

As you can see, the Section 754 Election involves a lot of moving parts. Whether it’s right for your situation depends on a number of factors, making it wise to consult with a professional who can guide you through the process. Here are some expert tips to help you get started:

- Evaluate the potential tax implications. Consider the potential capital gains tax liability if you don’t elect Section 754, as well as the potential for increased taxable income in the future due to distributions from the business.

- Consider the long-term plan for the inherited asset. If you plan to sell the asset soon after inheriting it, the Section 754 Election is likely a wise choice. However, if you plan to hold the asset for a long time, the benefits of the election may be less significant.

- Consult with a tax advisor. They can help you assess the risks and benefits of the Section 754 Election in your specific situation.

FAQs about Section 754 Election

Here are answers to some common questions about the Section 754 Election.

Q: Is the Section 754 Election mandatory?

A: No, the Section 754 Election is not mandatory. It is an elective provision, and the estate or trust must formally make the election to receive its benefits. However, once the election is made, it applies to all future distributions from the partnership or S corporation.

Q: How do I make a Section 754 Election?

A: The Section 754 Election must be made with the Internal Revenue Service (IRS) by filing Form 8586, “Information Return for a Partnership With a Section 754 Election.” This form is generally filed with the partnership tax return for the tax year in which the inheritance occurs.

Q: What are the time constraints for electing Section 754?

A: There are deadlines for making a Section 754 Election. It must be made within two years and 180 days of the end of the tax year in which the transfer of the partnership or S corporation interest occurred. This means that there’s a limited timeframe for making the election; taking action quickly is essential.

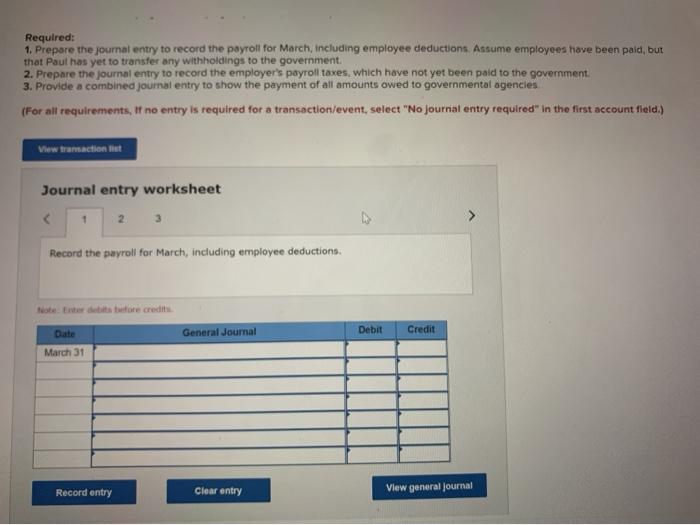

Journal Entry For Section 754 Election

Conclusion: Embracing the Section 754 Election, A Powerful Tool for Estate Planning

Navigating the complex world of estate planning can be daunting, but understanding valuable tools like the Section 754 Election empowers you to make informed decisions. Whether you’re inheriting a family business, real estate holdings, or other valuable assets, recognizing the potential tax advantages and navigating the intricacies of this election can save you a considerable amount of money.

Remember, the information provided in this journal entry is intended for educational purposes only and should not be interpreted as legal or financial advice. Consulting with a qualified professional specializing in tax and estate planning is crucial for making personalized choices that align with your unique circumstances.

Are you interested in exploring the potential benefits of the Section 754 Election for your estate planning?

:max_bytes(150000):strip_icc()/OrangeGloEverydayHardwoodFloorCleaner22oz-5a95a4dd04d1cf0037cbd59c.jpeg?w=740&resize=740,414&ssl=1)