As a seasoned accountant, I’ve encountered countless challenges and perplexing scenarios throughout my career. One such instance that stands out vividly is my experience with a small business owner who was grappling with the concept of closing entries. He was confused about the process and its importance, leading to a significant delay in his financial reporting. This encounter solidified my understanding of the crucial role that closing entries play in the accounting cycle and the importance of providing clear and concise explanations to ensure understanding.

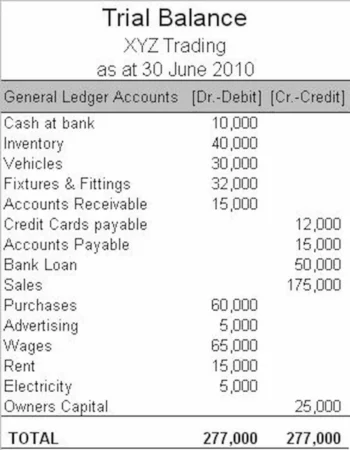

Image: www.bookstime.com

This article aims to dissect the nuances of Problem 10-6, a common accounting problem that delves into the process of journalizing closing entries. Through a detailed exploration of the subject matter, we will gain a thorough understanding of this fundamental aspect of accounting and its implications for accurate financial reporting.

Understanding Closing Entries and Their Role in the Accounting Cycle

At the end of each accounting period, a series of entries known as closing entries are made to prepare the company’s books for the start of a new period. These entries serve two primary purposes:

- Transferring Temporary Account Balances: Closing entries transfer the balances of temporary accounts, also known as nominal accounts, to permanent accounts, primarily the retained earnings account. Temporary accounts, such as revenue and expense accounts, reflect the company’s financial performance during a specific period. In contrast, permanent accounts, like assets, liabilities, and equity accounts, represent the company’s financial position. Closing entries ensure that temporary account balances are reset to zero at the beginning of each new period, enabling an accurate reflection of the current accounting period’s performance.

- Preparing for the New Period: Closing entries also play a crucial role in preparing the financial statements for the upcoming accounting period. By zeroing out the temporary accounts, closing entries create a clean slate for recording transactions in the next period, ensuring that the financial reports accurately represent the current period’s financial performance without any carry-over from previous periods.

A Step-by-Step Guide to Problem 10-6: Journalizing Closing Entries

Problem 10-6 typically presents a scenario that requires the student to journalize the closing entries for a specific accounting period. The problem may include information about the company’s revenues, expenses, and other relevant account balances. To effectively solve this problem, follow these steps:

Step 1: Identify the Temporary Accounts

Begin by meticulously examining the provided information to identify all temporary accounts, including revenues, expenses, and dividend accounts. These accounts represent the company’s financial performance during the current accounting period and need to be closed at the end of the period.

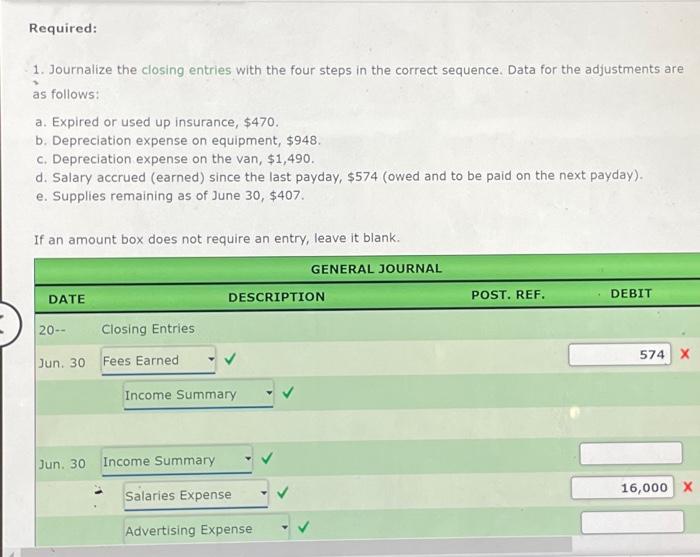

Image: www.chegg.com

Step 2: Calculate the Net Income or Loss

Calculate the net income or loss for the period by subtracting total expenses from total revenues. A positive value signifies net income, while a negative value indicates a net loss. This calculation is essential for determining the amount to be transferred to the retained earnings account.

Step 3: Journalize the Closing Entries

Journalize the closing entries for each temporary account, following these general rules:

- Revenue Accounts: Debit each revenue account for the period’s balance and credit the income summary account.

- Expense Accounts: Credit each expense account for the period’s balance and debit the income summary account.

- Dividend Accounts: Credit the dividend account for the period’s balance and debit the retained earnings account.

- Income Summary Account: Close the income summary account by debiting or crediting it with the net income or loss calculated in Step 2. The income summary account is then closed to the retained earnings account.

Tips for Success in Solving Problem 10-6

Here are some helpful tips to ensure you successfully solve Problem 10-6 and master the art of journalizing closing entries:

- Focus on the Debit and Credit Rules: Remember the fundamental rules of debit and credit. Assets and expenses have a debit balance, while liabilities, equity, and revenues have a credit balance. Apply these rules meticulously when journalizing closing entries.

- Pay Attention to the Order of Closing Entries: The order in which you close the temporary accounts matters. It is generally recommended to close revenue accounts first, followed by expense accounts, and finally, dividend accounts.

- Double-Check Your Entries: Before finalizing your journal entries, carefully review them to ensure that the debits equal the credits in each entry and that all accounts are closed correctly.

These tips can help you avoid common errors and ensure that your journalizing process is accurate and efficient.

Common FAQs on Journalizing Closing Entries

Here are some frequently asked questions regarding closing entries:

Q: Why are closing entries necessary?

Closing entries are necessary to ensure that the temporary accounts, which are used to track a company’s financial performance for the current period, are reset to zero at the end of the period. This ensures that the accounts are ready to reflect the financial performance for the next period.

Q: What happens if closing entries are not made?

If closing entries are not made, the temporary account balances will carry over to the next period, resulting in inaccurate financial reporting. The balances of these accounts will not reflect the company’s current financial performance.

Q: How often are closing entries made?

Closing entries are usually made at the end of each accounting period, which can be monthly, quarterly, or annually. The specific frequency depends on the company’s needs and accounting standards.

Problem 10-6 Journalizing Closing Entries

Conclusion

Mastering the concept of journalizing closing entries is a fundamental aspect of accounting. By understanding the process and applying the tips provided, you can successfully navigate Problem 10-6 and enhance your accounting skills. Remember, closing entries are essential for accurately reflecting a company’s financial performance and preparing for the next accounting period.

Are you interested in learning more about accounting concepts and skills?

:max_bytes(150000):strip_icc()/OrangeGloEverydayHardwoodFloorCleaner22oz-5a95a4dd04d1cf0037cbd59c.jpeg?w=740&resize=740,414&ssl=1)