Have you ever felt overwhelmed by the seemingly complex world of accounting? It can be a challenge to grasp the intricate details of financial transactions, especially when you’re just starting out. I remember vividly my own early days with accounting, struggling to understand how to record various transactions in the general journal. It felt like deciphering an ancient code! But with practice and a clear understanding of the fundamentals, I learned to navigate the process with confidence.

Image: www.chegg.com

This blog post is designed to demystify the process of general journal entries, particularly focusing on Problem 6-4, a common practice problem encountered in many accounting textbooks. We’ll break down the steps involved, explore the various types of transactions, and provide you with the tools you need to confidently record financial information.

Understanding General Journal Entries and Problem 6-4

The general journal serves as the primary record of all financial transactions within a business. It’s a chronological listing of every debit and credit entry, providing a complete picture of the company’s financial activity. Each entry consists of a date, a description of the transaction, the accounts affected, and the corresponding debit and credit amounts. This structured approach ensures that all business transactions are accurately tracked and can be easily reconciled.

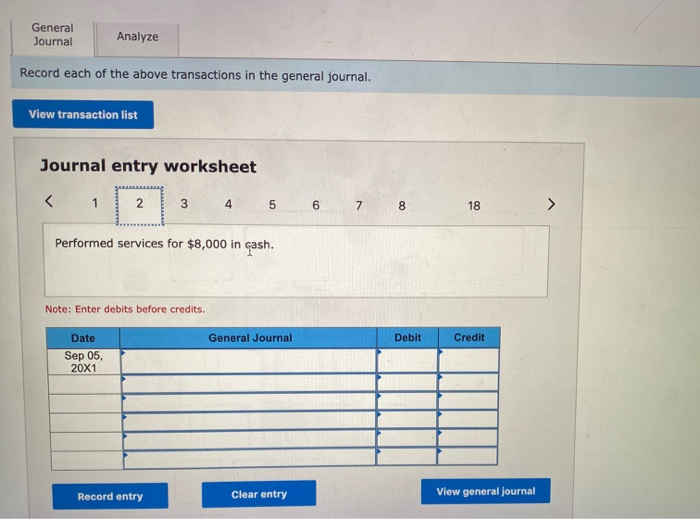

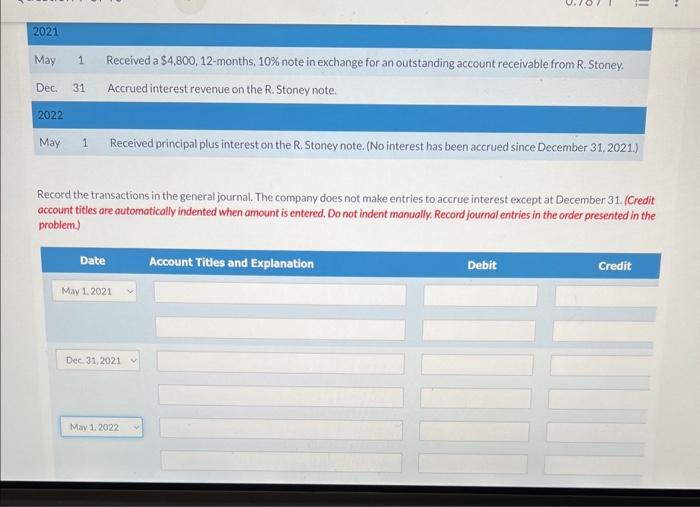

Problem 6-4, often found in accounting textbooks, presents a series of transactions that students are required to record in the general journal. These problems typically cover a variety of common business activities like sales, purchases, payments, and receipts. They provide a valuable platform for students to practice their understanding of journal entries and to develop a firm grasp of the fundamental accounting principles that govern the recording of financial transactions.

Diving Deeper into Problem 6-4: A Step-by-Step Guide

Let’s break down the process of recording general journal transactions in Problem 6-4. It typically involves the following steps:

- Identify the accounts affected: The first step is to pinpoint the accounts that are impacted by the transaction. These can include asset, liability, equity, revenue, or expense accounts. For instance, if a business buys inventory on credit, the accounts affected would be Inventory (an asset) and Accounts Payable (a liability).

- Determine the type of entry: Every transaction involves at least two accounts, one with a debit entry and the other with a credit entry. The type of entry depends on the nature of the transaction. For example, if a company receives cash for services rendered, the entry would be a debit to Cash (an asset) and a credit to Service Revenue (revenue).

- Ensure the debit and credit amounts are equal: The fundamental accounting equation (Assets = Liabilities + Equity) dictates that for every debit, there must be an equal and opposite credit. This ensures that the accounting equation remains balanced, maintaining the integrity of the financial records. This is the heart of double-entry bookkeeping and is essential for accurate financial reporting.

- Record the transaction in the general journal: Once you’ve determined the accounts and the amounts involved, the final step is to record the transaction in the general journal. This includes the date, a brief description of the transaction, the account titles, and the debit and credit amounts. It’s crucial to record these details meticulously as they form the foundation for financial statements and analysis.

Common General Journal Entries in Problem 6-4

Problem 6-4 often features a variety of transactions representative of common business activities. Let’s explore some of these, understanding how they are recorded in the general journal.

Image: www.chegg.com

1. Sales on Account

A sale on account occurs when a business sells goods or services to a customer but doesn’t receive immediate payment. This transaction impacts two accounts: Accounts Receivable (an asset), which represents the amount owed by the customer, and Sales Revenue (revenue). The entry would be a debit to Accounts Receivable and a credit to Sales Revenue.

2. Purchases on Account

Similarly, purchases on account occur when a business buys goods or services from a supplier on credit. The accounts affected are Purchases (an expense) or Inventory (an asset) and Accounts Payable (a liability). The entry would be a debit to Purchases or Inventory and a credit to Accounts Payable.

3. Cash Receipts

A cash receipt occurs when a business receives cash for services rendered or product sales. This affects Cash (an asset) and either Sales Revenue or Accounts Receivable. The entry would be a debit to Cash and credit to Sales Revenue or Accounts Receivable.

4. Cash Payments

Cash payments are made for expenses like rent, utilities, salaries, or purchases. They impact Cash (an asset) and the specific expense account or liability being paid. The entry would be a debit to the expense account or liability and a credit to Cash.

Tips and Expert Advice for Mastering General Journal Entries

Learning to record general journal entries is a fundamental skill in accounting. Here are some tips to help you master this process:

- Practice regularly: The best way to learn is by doing. Work through practice problems like Problem 6-4, focusing on understanding the logic behind each entry. The more you practice, the more comfortable you’ll become.

- Use a chart of accounts: A chart of accounts is a comprehensive list of all the accounts used by a company. This helps to ensure consistent and accurate account naming and labeling, simplifying the process of recording transactions.

- Understand the accounting cycle: General journal entries are part of a larger accounting cycle that involves various stages like posting to ledgers, preparing trial balances, and generating financial statements. Understanding the complete process provides a broader context for your work.

- Seek clarification when needed: Don’t be afraid to ask your instructor, classmates, or a tutor if you encounter any difficulties. It’s always better to seek clarification than to continue with misunderstandings.

- Utilize online resources: Many excellent online resources are available to help you learn accounting, including videos, tutorials, and practice quizzes. Take advantage of these resources to enhance your understanding.

General Journal Entries: Frequently Asked Questions

Here are some common questions about general journal entries:

Q: What is the difference between a debit and a credit?

A: Debits increase asset and expense accounts and decrease liability, equity, and revenue accounts. Credits decrease asset and expense accounts and increase liability, equity, and revenue accounts.

Q: Why is it important to record general journal entries accurately?

A: Accurate general journal entries are the foundation of a company’s financial statements. Errors can lead to misstatements of income, assets, and liabilities, potentially impacting business decisions and investor confidence.

Q: Can I use software programs to record general journal entries?

A: Absolutely! Accounting software like QuickBooks, Xero, and Sage simplifies the process of recording general journal entries, offering automation and error prevention features.

Problem 6-4 Recording General Journal Transactions

Conclusion

Mastering the process of recording general journal transactions is essential for aspiring accountants and anyone involved in financial record-keeping. Problem 6-4 provides a valuable platform for practicing this skill, guiding you through common business scenarios and helping you develop confidence. Remember, practice, understanding the accounting cycle, and utilizing available resources can greatly enhance your ability to record financial transactions accurately and efficiently. Are you ready to tackle Problem 6-4 with confidence?

:max_bytes(150000):strip_icc()/OrangeGloEverydayHardwoodFloorCleaner22oz-5a95a4dd04d1cf0037cbd59c.jpeg?w=740&resize=740,414&ssl=1)