Ever wondered about that extra charge on your shopping spree in Colorado? It’s not a mysterious surcharge, but a sales tax, a vital component of the state’s revenue stream. You might think it’s just a minor addition, but understanding the complexities of Colorado’s sales tax can actually save you money and empower you as a consumer.

Image: stepbystepbusiness.com

Imagine this: you’re strolling through a bustling Colorado market, a basket overflowing with fresh produce, local crafts, and maybe even a Colorado Rockies hat. As you reach the checkout, the cashier rings up your purchases, and there it is: the sales tax. You might instinctively view it as an extra expense, but in reality, it plays a crucial role in funding essential services, from education to roads to public safety. This article dives deep into the intricacies of Colorado’s sales tax, revealing its impact on your wallet and your community.

Navigating the Maze of Colorado’s Sales Tax: Unraveling the Fundamentals

Colorado, like most states, has a sales tax, a form of consumption tax levied on the purchase of goods and services. This tax is not a flat rate across the board; it varies depending on the city and county in which you’re making a purchase. This might seem like a confusing situation, but it’s actually designed to provide flexibility and local control in funding specific needs.

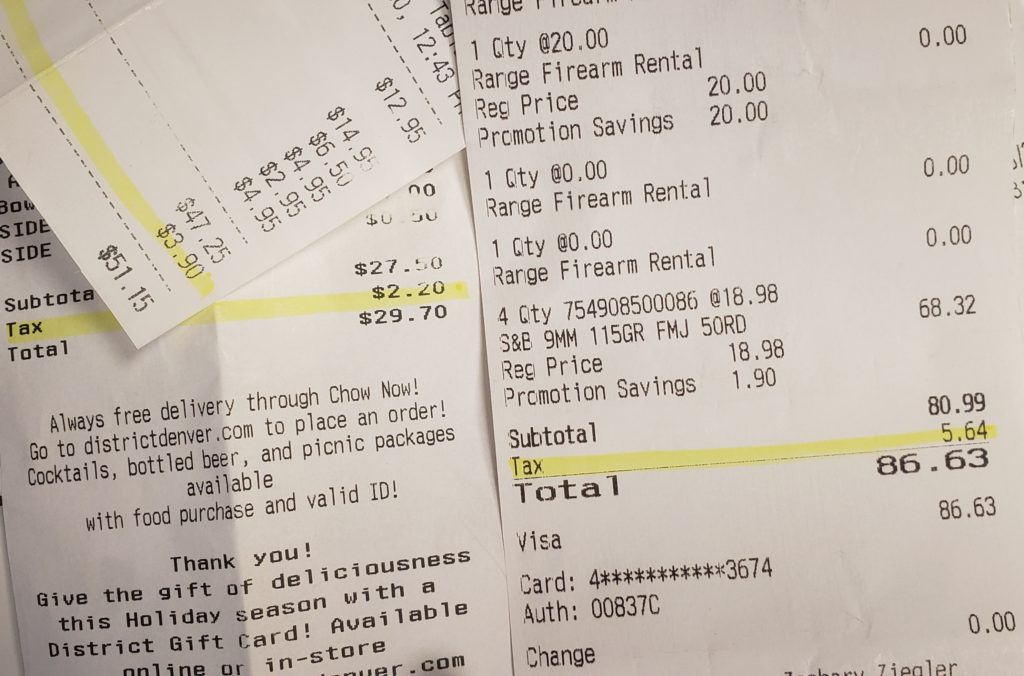

Let’s break it down. Colorado’s statewide sales tax sits at 2.9%, a rate that applies uniformly throughout the state. However, cities and counties can tack on their local sales tax, which can range from 0 to 4.5%, adding a considerable difference to your final bill. For instance, in the vibrant city of Denver, you’ll encounter a 4.72% local sales tax on top of the statewide rate, resulting in a total sales tax of 7.62%. On the other hand, a slower-paced mountain town like Breckenridge might have a lower local sales tax rate, impacting the final cost of your purchases.

Beyond the Basic Rate: Understanding the Nuances of Colorado’s Sales Tax

Now let’s get down to specifics. While the sales tax in Colorado generally applies to most goods and services, there are certain exceptions. For example, groceries are exempt from sales tax, meaning you won’t have to pay that extra charge on your weekly grocery haul. However, there’s a twist: prepared food items like restaurant meals and snacks sold at convenience stores are subject to sales tax. This means your burrito bowl at your favorite eatery will come with that added cost.

Additionally, certain goods considered essential, such as prescription medications and medical devices, are also exempt from sales tax. This ensures that essential healthcare needs are not burdened by unnecessary additional costs. However, it’s important to note that over-the-counter medications and beauty products are subject to sales tax, which means you’ll need to factor that into your budget.

Furthermore, tangible personal property, commonly known as “tangibles,” such as furniture, electronics, and clothing, are typically subject to sales tax. This means that if you’re upgrading your home with new furniture or finally finding that perfect pair of hiking boots, you’ll be paying the sales tax. But here’s a helpful tip: certain items, like used clothing or equipment, are often exempt from sales tax, making those second-hand purchases a little more affordable.

Beyond Goods: Services Included in Colorado’s Sales Tax

Now let’s turn our attention to services. While many services are subject to sales tax, there are notable exceptions. For example, services like healthcare, education, and childcare are typically exempt from sales tax. However, beauty services like haircuts and manicures, along with entertainment services like movie tickets and concerts, are subject to sales tax, making those activities slightly more expensive.

In essence, Colorado’s sales tax is a complex system with numerous exceptions and variances. It’s essential to stay informed about these nuances to avoid any surprises at the checkout. While it can seem complicated, a little research can go a long way in understanding how these taxes affect your everyday purchases. Remember, knowing how sales tax works can actually save you money and ensure that you’re making informed choices as a consumer.

Image: i2i.org

Navigating the Tax Landscape: Tips for Smart Shopping

While Colorado’s sales tax system may seem complex, there are ways to navigate it effectively. One crucial tip is to research the specific sales tax rates for the city or county you’re shopping in. Many online resources, including the Colorado Department of Revenue website, provide comprehensive information on local sales tax rates, allowing you to plan ahead.

Another smart move is taking advantage of tax-exempt days. For example, during certain periods, Colorado exempts some items from sales tax, offering opportunities to save significantly. Keep an eye out for these exemptions, as they can provide substantial savings on items like clothing or school supplies.

And don’t underestimate the power of shopping around. Different stores and retailers may offer varying levels of discounts, promotions, or even price differences due to local variations in sales tax rates. By doing your research, you can often find the best deals and potentially save money on your purchases.

Understanding the Bigger Picture: The Impact of Sales Tax

Beyond your personal finances, it’s important to understand the broader role of sales tax in Colorado. The revenue collected through this tax is the lifeblood of many vital services that benefit all Coloradans. From funding schools to maintaining road infrastructure to supporting critical public health measures, sales tax plays a vital role in ensuring the well-being of our communities. By contributing to this tax, we are actively investing in a healthier, safer, and more prosperous Colorado.

How Much Is The Sales Tax In Colorado

Final Thought: Empowering Yourself as a Consumer

As you navigate the aisles of your favorite Colorado stores or explore local businesses, remember that understanding sales tax is not just about managing your personal finances; it’s about understanding the fabric of our society. Empowering yourself with knowledge about Colorado’s sales tax system allows you to make informed decisions, shop smarter, and contribute to the continued success of our communities.

:max_bytes(150000):strip_icc()/OrangeGloEverydayHardwoodFloorCleaner22oz-5a95a4dd04d1cf0037cbd59c.jpeg?w=740&resize=740,414&ssl=1)