Have you ever wondered why the price of gasoline seems to spike during the summer, or why certain grocery items always remain relatively affordable? These fluctuations are often a result of government interventions in the free market, specifically through price ceilings and price floors. These measures, while seemingly simple, can have profound and sometimes unexpected consequences on supply and demand, influencing everything from consumer behavior to the overall health of the economy.

Image: admin.itprice.com

This article delves into the world of price ceilings and price floors, exploring how they work, their impact on the market, and the potential unintended consequences they can bring. We’ll examine real-world examples to illustrate these concepts, providing clarity and insights into how these government interventions shape the markets we interact with every day. We’ll also equip you with the knowledge and vocabulary to understand the complex economic forces at play, enabling you to navigate the dynamic world of supply and demand.

Price Ceilings: The Limits of Low Prices

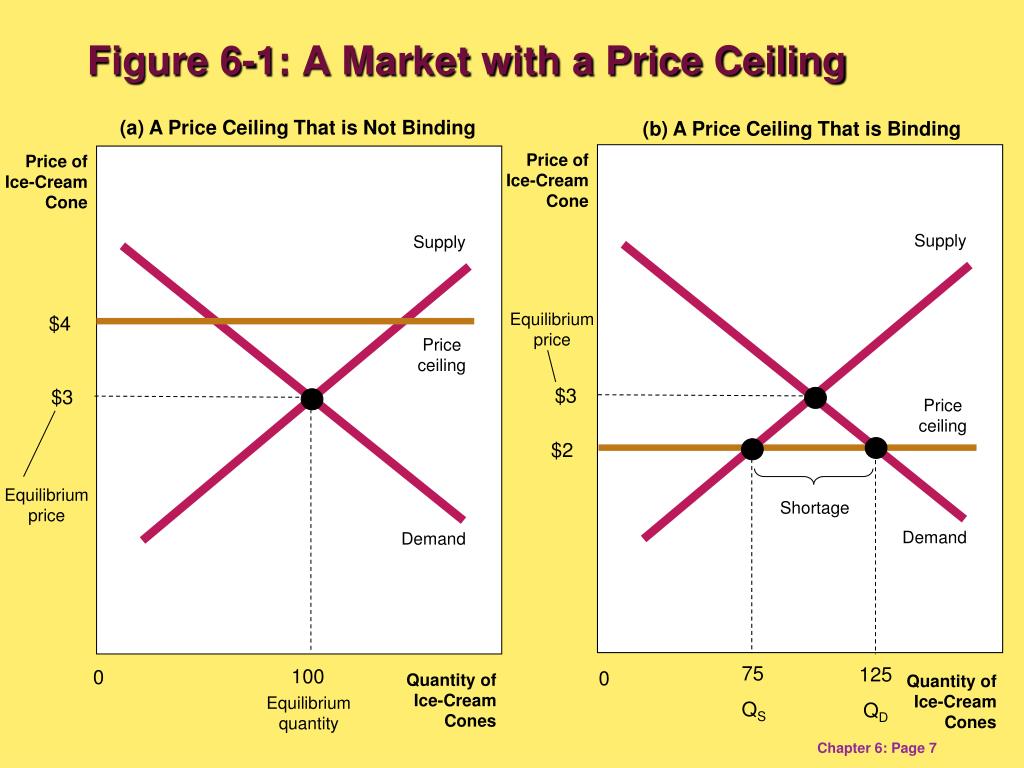

Imagine a world where essential goods like food and medicine are available at drastically reduced prices. This is the idea behind a price ceiling – a government-imposed maximum price that sellers can charge for a specific good or service. The goal is typically to make these goods more affordable for consumers. However, the real impact of price ceilings can be far more complex.

Let’s consider rent control, which is a common example of a price ceiling applied to the housing market. Cities often implement rent control to make housing more affordable for low-income residents. But if the rent control price is set below the equilibrium price (where supply and demand balance), the quantity of available housing units will decrease. This is because landlords may not find it financially feasible to rent units at a price that is below their costs, leading to a shortage of housing.

Similarly, consider a price ceiling on gasoline, implemented to curb inflation during a fuel shortage. While this may initially make gasoline more affordable for consumers, it can also discourage oil producers from producing and supplying more gasoline. Consequently, shortages will worsen, leading to longer wait times at gas stations, increased black market activity, and a greater potential for social unrest.

Price Floors: Setting the Minimum

On the other hand, price floors are government-imposed minimum prices that sellers can charge for a good or service. These are often put in place to protect producers, ensuring they receive a fair price for their goods. A common example is the minimum wage, imposed to ensure a baseline wage for workers. Price floors aim to prevent producers from selling their goods at prices too low to cover their costs.

However, the intended benefits of price floors can have unintended consequences. Consider a price floor placed on agricultural products like wheat. While this guarantees a higher price for farmers and may seem beneficial, it can lead to a surplus of wheat as supply exceeds consumer demand at the higher price point. This ultimately benefits farmers, but it can result in higher food prices for consumers and lead to government intervention through agricultural subsidies or crop buyback programs to manage the surplus.

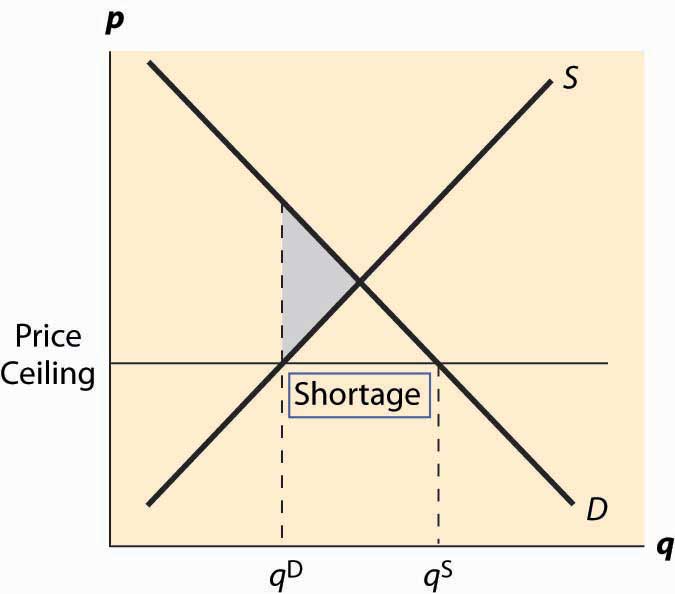

The Importance of Equilibrium

Both price ceilings and price floors aim to intervene in the free market and influence supply and demand dynamics. However, it’s crucial to understand that free markets naturally operate towards an equilibrium price point. This is the price where the quantity supplied and the quantity demanded meet. When the government sets a price ceiling or floor that deviates significantly from this equilibrium, it disrupts the market forces and can lead to unintended outcomes.

Image: flatworldknowledge.lardbucket.org

Unintended Consequences: Shortage and Surplus

Price ceilings, when set below the equilibrium price, can lead to a shortage. This arises because sellers find it unprofitable to supply goods at the artificially low price, leading to a decrease in supply. As demand remains high, buyers are left competing for limited goods, potentially causing black markets and increased consumer frustration.

Conversely, price floors, when set above the equilibrium price, can lead to a surplus. This occurs because suppliers are encouraged to produce more at the higher price, but consumers are not willing to buy as much at that price. The surplus can be a burden on producers, requiring government intervention to manage or dispose of excess goods, ultimately impacting taxpayers.

Real-World Examples: Price Ceilings and Price Floors in Action

Understanding the real-world application of these concepts can help us grasp their complexities. Let’s examine some examples:

Example 1: Housing Market and Rent Control

New York City’s rent control policies provide a compelling example. While intended to combat rising housing costs and protect low-income residents, it has led to shortages in available housing. Landlords are incentivized to keep existing units vacant rather than rent them at controlled prices, potentially discouraging new construction and exacerbating the housing crisis.

Example 2: Minimum Wage and Employment

The minimum wage is a prime example of a price floor. The intent is to ensure a livable wage for workers, but evidence suggests that minimum wage increases can lead to job losses, particularly for low-skilled workers. This is because some employers may not be able to afford to pay the higher wage, leading them to reduce their workforce or automate certain tasks.

Example 3: Agricultural Price Supports

Governments often provide price supports for agricultural products like milk, wheat, and corn. These supports guarantee a certain minimum price for farmers, but they can lead to overproduction and surpluses. These surpluses require government intervention through subsidies or buyback programs, potentially impacting taxpayers and distorting market signals.

Quizlet: A Valuable Resource for Learning

Quizlet is an excellent platform for learning and memorizing important economic concepts. You can find a multitude of flashcards and study sets related to price ceilings, price floors, and other economic topics. These resources can help you reinforce your understanding of these concepts and prepare for quizzes or exams. By creating your own flashcards or studying those created by others, you can actively engage with the material and solidify your knowledge.

Tips for Effective Quizlet Usage:

- Create and use flashcards with relevant definitions, examples, and diagrams.

- Utilize the various study modes offered by Quizlet, including matching, learn, and test.

- Create or join study groups to collaborate and reinforce learning.

- Refer to your textbooks and other supplementary materials to supplement your Quizlet study.

Price Ceilings And Price Floors That Are Binding Quizlet

Conclusion: Navigating the Complexities

Understanding price ceilings and price floors is crucial for anyone seeking to grasp the complexities of economic policy and market interventions. These seemingly simple measures can have far-reaching consequences, affecting everything from individual purchasing power to government budgets. By recognizing the potential benefits and drawbacks, we can better understand how these policies shape the markets we interact with every day. Quizlet, with its user-friendly platform and readily available resources, offers a valuable tool for learning and solidifying your understanding of these concepts. So, dive into the world of price ceilings and price floors, and equip yourself with the knowledge to navigate the complexities of the market.

:max_bytes(150000):strip_icc()/OrangeGloEverydayHardwoodFloorCleaner22oz-5a95a4dd04d1cf0037cbd59c.jpeg?w=740&resize=740,414&ssl=1)