Remember that time you were browsing the internet and stumbled upon a digital artwork that was selling for thousands of dollars? That was probably an NFT, and the price tag you saw was likely the “floor price.” For many, the world of NFTs can feel confusing and inaccessible. But understanding the floor price is a crucial first step towards navigating this exciting new market.

Image: nftniches.com

In this guide, we’ll demystify the meaning of the floor price and explore its significance within the NFT ecosystem. Prepare to dive into the exciting realm of digital ownership and discover how the floor price influences your NFT investment journey.

Decoding the Floor Price: What It Means and Why It Matters

The floor price of an NFT collection refers to the lowest price at which a specific NFT within that collection is currently being listed for sale on a marketplace. Think of it as the starting point for purchasing an NFT from a certain collection. For instance, if the floor price of a popular NFT collection is 0.5 ETH (Ethereum), then you can’t purchase any NFT from that collection for less than 0.5 ETH.

While the floor price might seem like just a number, it holds considerable weight in the NFT world. It acts as a barometer for the overall demand and popularity of a collection. If the floor price rises, it indicates increased interest and potential value appreciation, while a decreasing floor price could signal waning interest or a shift in market sentiment.

Understanding How Floor Prices are Determined

The floor price of an NFT collection is determined through a dynamic process that reflects market forces and community sentiment. As new listings emerge and existing ones are bought and sold, the floor price evolves in real time. Here’s a closer look at the factors influencing this price:

Supply and Demand: The Foundation of Value

Like any other market, the interplay between supply and demand heavily influences the floor price of NFT collections. If a collection has a limited supply and high demand, the floor price is likely to be high. Conversely, a collection with a large supply and low demand could experience a lower floor price.

Image: cyberscrilla.com

The Role of Marketplaces and Listings

NFT marketplaces like OpenSea, Rarible, and Nifty Gateway provide the platform for listing and trading NFTs. These marketplaces display the lowest price that sellers are willing to accept for a given NFT, contributing to the floor price determination. As new listings appear and existing ones are bought and sold, the floor price fluctuates accordingly.

Community Engagement and Social Media Buzz

The NFT community plays a vital role in shaping floor prices. Social media platforms, particularly Twitter and Discord, are hubs for discussion, speculation, and promotion of specific collections. Positive sentiment and active engagement can lead to an increase in floor prices, while negative news or lack of community support may lead to declines.

Intrinsic Value and Utility

Beyond market forces, the floor price of an NFT collection can also be influenced by factors related to the collection itself. These include the artistic merit of the NFTs, their utility within the metaverse or gaming ecosystems, and the overall brand reputation of the collection.

Trends and Developments in Floor Price Dynamics

The world of NFTs is constantly evolving, and the way floor prices are determined and influenced is no exception. Here are some notable trends and developments in the NFT space:

Increased Institutional Investment

More traditional investors, including hedge funds and financial institutions, are showing growing interest in the NFT market. This influx of capital could lead to increased volatility in floor prices as large-scale investments influence market dynamics.

Metaverse Integration

The growing popularity of the metaverse and its potential to offer unique digital experiences is expected to impact floor prices. NFTs with metaverse utility, such as virtual land or avatars, could see significant value appreciation as more people embrace virtual worlds.

New Marketplaces and Technologies

The emergence of new NFT marketplaces and blockchain technologies is constantly reshaping the landscape. Platforms with innovative features and functionalities could impact floor price dynamics by attracting new users and creating new opportunities for trading and monetization.

Expert Tips for Navigating Floor Prices

Understanding the concept of floor price is a valuable first step, but navigating the complex world of NFTs requires practical knowledge. Here are some tips from experienced NFT enthusiasts:

Conduct Thorough Research

Before investing in any NFT collection, it’s crucial to research the project thoroughly. Understand the team behind the collection, the utility of the NFTs, the community engagement, and the overall market sentiment surrounding the collection.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your NFT portfolio by investing in a range of collections across different sectors and thematic areas. This helps mitigate risk and potentially unlock greater returns.

Set Realistic Expectations

While NFTs offer potential for significant gains, it’s essential to have realistic expectations. The NFT market is highly volatile, and floor prices can fluctuate dramatically. Avoid chasing hype and rely on sound due diligence before making investment decisions.

FAQ: Frequently Asked Questions about Floor Prices

Q: What is the difference between the floor price and the average price of an NFT collection?

A: The floor price is the lowest price for which an NFT from a collection is currently listed for sale. The average price is calculated by averaging the prices of all NFTs in a collection that have been sold recently.

Q: Can the floor price of an NFT collection drop to zero?

A: Yes, if a collection loses popularity and demand, the floor price can decline significantly. However, this is not as common with established and reputable NFT collections.

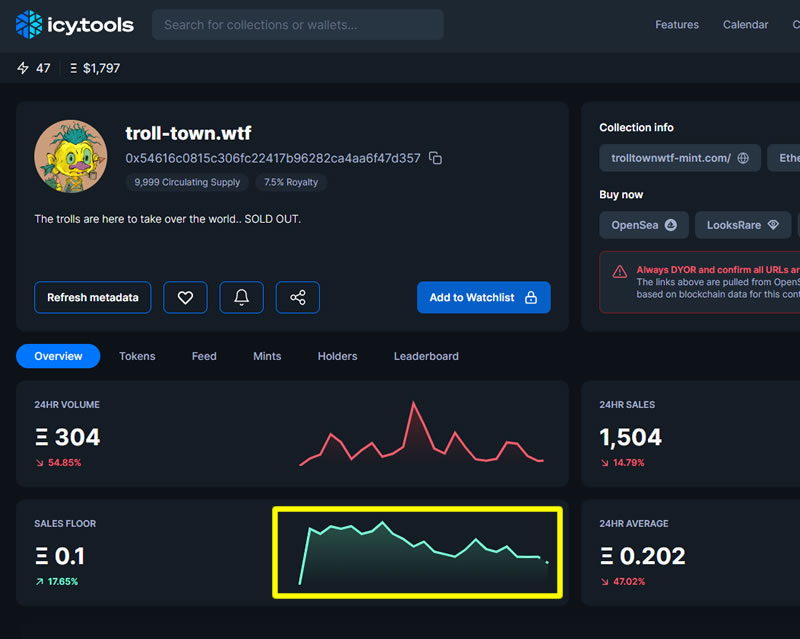

Q: How can I track the floor price of an NFT collection?

A: You can track the floor price of NFT collections on various marketplaces like OpenSea, Rarible, and Nifty Gateway. These platforms provide real-time updates on the lowest asking price for specific collections.

Q: Should I always buy an NFT at the floor price?

A: Not necessarily. The floor price is a good starting point, but you can often find slightly higher-priced NFTs that are more desirable or have unique features.

Q: Is the floor price a reliable indicator of the value of an NFT?

A: The floor price is a valuable indicator, but it’s not the only factor to consider when assessing the value of an NFT. Other factors such as the project’s utility, community engagement, and overall market sentiment play a crucial role.

What Is The Floor Price Of An Nft

Conclusion: Embracing the Floor Price and Navigating the NFT Landscape

The floor price is a fundamental concept in the NFT world, serving as a starting point for understanding the value and demand of various collections. By understanding floor price dynamics, conducting thorough research, and diversifying your investments, you can navigate the exciting and often volatile landscape of NFTs.

Are you interested in learning more about the floor price of specific NFT collections or the broader NFT market? Share your thoughts and questions in the comments below, and let’s dive deeper into the fascinating world of digital ownership together!

:max_bytes(150000):strip_icc()/OrangeGloEverydayHardwoodFloorCleaner22oz-5a95a4dd04d1cf0037cbd59c.jpeg?w=740&resize=740,414&ssl=1)